How To Calculate Deferred Tax Using Balance Sheet Method . calculate the deferred tax adjustment using the balance sheet approach for both years. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable.

from ag.purdue.edu

calculate the deferred tax adjustment using the balance sheet approach for both years. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable.

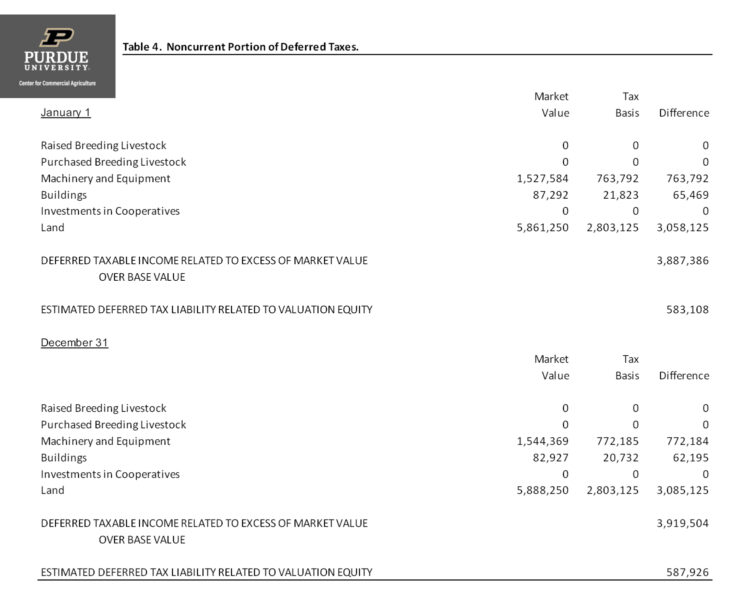

Computation of Deferred Tax Liabilities Center for Commercial Agriculture

How To Calculate Deferred Tax Using Balance Sheet Method as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. calculate the deferred tax adjustment using the balance sheet approach for both years.

From analystprep.com

Valuation Allowance for Deferred Tax Assets CFA Level 1 AnalystPrep How To Calculate Deferred Tax Using Balance Sheet Method frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.scribd.com

Tariq Deferred Tax Balance Sheet How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. . How To Calculate Deferred Tax Using Balance Sheet Method.

From www.youtube.com

How Deferred TAX Asset and Deferred TAX Liabilities Works In Profit How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. a deferred tax asset or dta is an entry on the balance sheet representing the difference between. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.sampleinvitationss123.com

Deferred Tax Rate Calculator A Guide to Understanding and Using This How To Calculate Deferred Tax Using Balance Sheet Method ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. frs 102, para 29.12 requires an entity to measure deferred tax using the tax. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.superfastcpa.com

How to Calculate Deferred Tax Assets or Liabilities for a Business How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. a deferred tax asset or dta is an entry on the balance sheet representing the difference between. How To Calculate Deferred Tax Using Balance Sheet Method.

From ag.purdue.edu

Computation of Deferred Tax Liabilities Center for Commercial Agriculture How To Calculate Deferred Tax Using Balance Sheet Method calculate the deferred tax adjustment using the balance sheet approach for both years. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. . How To Calculate Deferred Tax Using Balance Sheet Method.

From ag.purdue.edu

Computation of Deferred Tax Liabilities Center for Commercial Agriculture How To Calculate Deferred Tax Using Balance Sheet Method calculate the deferred tax adjustment using the balance sheet approach for both years. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. as we have. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.slideserve.com

PPT Deferred Tax Examples PowerPoint Presentation, free download ID How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. frs 102, para 29.12 requires an entity to measure deferred tax using the. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.investopedia.com

Deferred Tax Asset Calculation, Uses, and Examples How To Calculate Deferred Tax Using Balance Sheet Method frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. . How To Calculate Deferred Tax Using Balance Sheet Method.

From sosuperpo.blogspot.com

Deferred Tax Computation Format / Corporate Tax Calculator Template How To Calculate Deferred Tax Using Balance Sheet Method calculate the deferred tax adjustment using the balance sheet approach for both years. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.youtube.com

Deferred Tax Explained with Example Profit & Loss approach and How To Calculate Deferred Tax Using Balance Sheet Method ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. a deferred tax asset is a line item on a company's balance sheet that. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.chegg.com

Solved QUESTION 1 1. Read and understand chapter 1 on How To Calculate Deferred Tax Using Balance Sheet Method as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.youtube.com

What is Deferred Tax asset & liabilities & How to Calculate deferred How To Calculate Deferred Tax Using Balance Sheet Method calculate the deferred tax adjustment using the balance sheet approach for both years. under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. as we have seen, ias. How To Calculate Deferred Tax Using Balance Sheet Method.

From accountsexamples.com

IAS 12 paras 81(c), 81(g) tax reconciliation and deferred tax balances How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. calculate the deferred tax adjustment using the balance sheet approach for both years. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of. How To Calculate Deferred Tax Using Balance Sheet Method.

From shotsrose.weebly.com

Deferred Tax Calculation Excel shotsrose How To Calculate Deferred Tax Using Balance Sheet Method a deferred tax asset or dta is an entry on the balance sheet representing the difference between taxes owed and the company’s internal. calculate the deferred tax adjustment using the balance sheet approach for both years. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering.. How To Calculate Deferred Tax Using Balance Sheet Method.

From fundsnetservices.com

Deferred Tax Assets When to Use them and How to Calculate! How To Calculate Deferred Tax Using Balance Sheet Method under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. a deferred tax asset is a line item on a company's balance sheet that reduces its taxable income. . How To Calculate Deferred Tax Using Balance Sheet Method.

From einvestingforbeginners.com

Deferred Tax Liabilities Explained (with RealLife Example in a How To Calculate Deferred Tax Using Balance Sheet Method under ias 12, deferred tax is calculated on a temporary difference approach, which focuses on the book values of assets and. as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. calculate the deferred tax adjustment using the balance sheet approach for both years. ias. How To Calculate Deferred Tax Using Balance Sheet Method.

From www.scribd.com

41 Balance Sheet Deferred Tax Expense How To Calculate Deferred Tax Using Balance Sheet Method as we have seen, ias 12 considers deferred tax by taking a “balance sheet” approach to the accounting problem by considering. frs 102, para 29.12 requires an entity to measure deferred tax using the tax rates and laws. ias 12 defines a deferred tax liability as being the amount of income tax payable in future periods in. How To Calculate Deferred Tax Using Balance Sheet Method.